Mr. Warren Buffet famously said, ‘Be fearful when others are greedy, and greedy when others

are fearful.’

So far, the markets have been volatile this year. No matter the cause, for long-term investors,

this market presents a fantastic opportunity. So, as Mr. Warren Buffett would like to say, it's

time to be greedy!

But before reading further, promise us one thing – you won’t just frame this quote (like most of us do with Mr. Buffett’s pearls of wisdom)

Act upon it right now as an attractive buying opportunity has opened up!

Here are 5 key reasons why we believe so

1. Inflation is within manageable range and has begun to rationalize

In India, inflation reached a high of 7.79% in April 2022. Since then, it has moderated in recent months and was 5.72% in December 2022. In January 2023, it inched up again to 6.52% but remains within the manageable range.

2. Government tax revenue buoyancy is evident

As per the recent Budget, the revised gross tax revenue receipt is expected to be Rs 30.43 trillion for FY23.This is approximately Rs 2.85 trillion higher than the earlier tax revenue estimate of Rs 27.57 trillion shared during last year’s budget. In the first 10 months, GST collection exceeded Rs 14.9 trillion, up 23.8% from the previous year. The direct tax collection up to 10th February 2023 shows that gross collections are at Rs. 15.67 trillion, which is also 24.09% higher than last year’s corresponding period. So, direct and indirect gross collections have been substantially buoyant.

3. Higher GDP growth than forecasted previously

As per the first advance estimates provided by MOSPI, the nominal GDP for FY23 is expected to be higher at Rs 273.08trillion, compared to the earlier estimate of Rs 268 trillion for FY23. Notably, this is a healthy 15% growth over the FY22 GDP of Rs 236.65 trillion. As per the Union Budget, India’s nominal GDP is pegged to grow at 10.5% in FY24 on a high base to Rs 301.75 trillion, which is quite impressive.

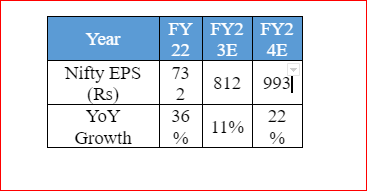

4. Continued healthy growth in corporate earnings despite a high base

Despite impressive earnings growth in FY22, analysts forecast an even bigger increase in earnings for the next two years. Valuation multiples look attractive at 17.6x compared to long-term averages of 18-20x, making this a good time to invest. Nifty earnings growth expectations

5. Rising bank credit growth and improving asset quality

The credit growth of banks is rising, and asset quality is improving. In the period that ended January 2023, total credit growth was up 16.3% YoY at Rs 133.4 trillion. Furthermore, the GNPA ratio of scheduled commercial banks continued to decline and reached a seven-year low of 5.0 %

in September 2022. In conclusion, I would like to share the lines from Rudyard Kipling’s poem ‘IF’ you can keep your head when all about you are losing theirs and blaming it on you; If you can trust yourself when all men doubt you, ... then yours is the earth and everything that's in it’. Therefore, one must STOP taking STRESS and instead look at the BIG PICTURE by taking advantage of such (The author of this article is Founder & Managing Director, Research & Ranking.)

(Disclaimer: The recommendations, if any, made herein are expression of views and/or opinions and should not be deemed or construed to be advice. Recipients of this article should rely on information/data from their own investigations and seek independent professional advice before executing any trades or investments. This article has been prepared based on publicly available information & internally developed data by Equentis Wealth Advisory Services Pvt. Ltd. (EWASPL). While due care has been taken to ensure that the opinions are fair and reasonable, EWASPL or its directors, employees, affiliates or representatives do not assume any responsibility for the accuracy and reliability of such information/opinions/views, nor shall be liable forany direct or indirect damages, including lost profits arising in any way or whatsoever form.)