RBI in its monetary policy on 8th February, hiked the repo rates by 25 bps. This was the sixth consecutive rate hike by RBI since May’22 taking the repo rate up by 250 bps to 6.5 percent currently.

The same is expected to increase by 25 bps during the upcoming 6th April’23 MPC meeting.

The non-food credit growth is up by 16.7 percent year-on-year (YoY) in Jan’23. This showcases the strong credit demand in the system despite higher rates.

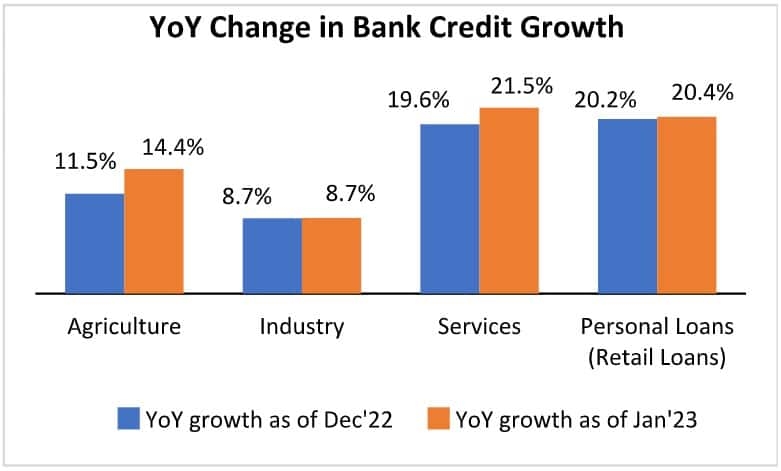

Jan’23 saw higher YoY credit growth as compared to Dec’22. There has been a major change in the credit growth in the agriculture and services sectors. While Industry (micro, small, medium and large) and personal loans (retail) have remained stable.

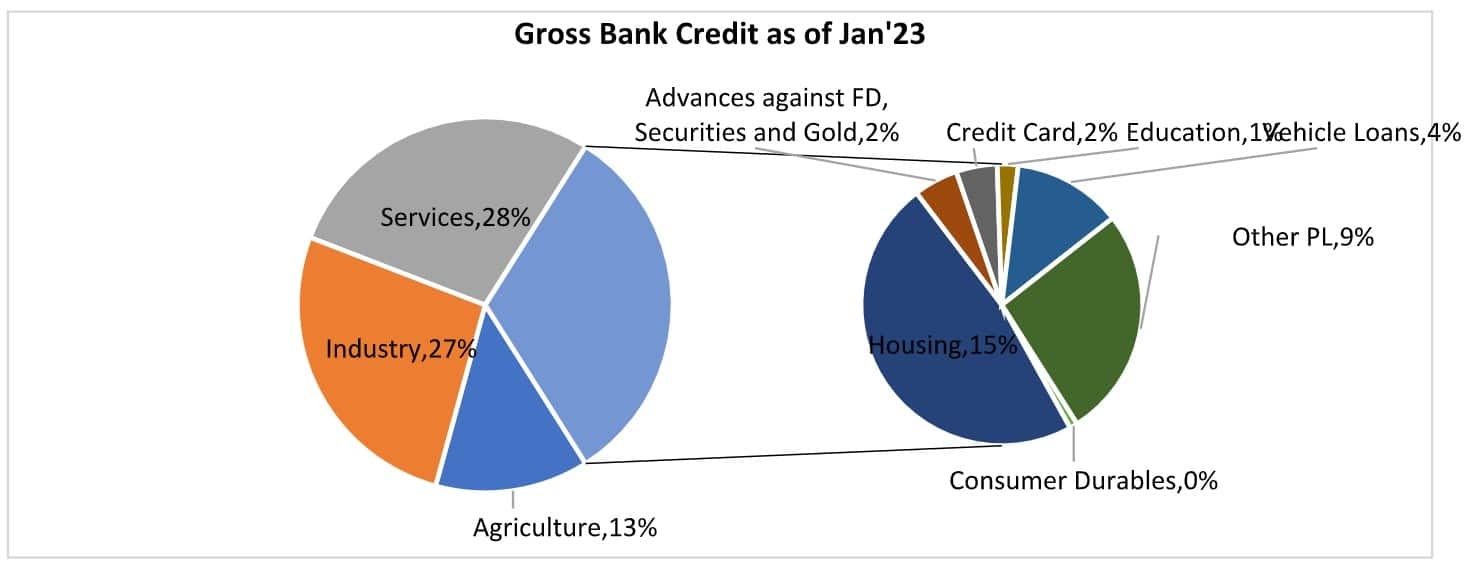

Out of the gross bank credit, the single largest contribution comes from the retail loan segment followed by the services sector.

In the retail loan segment, the housing and vehicle loan segment contributes the highest and hence these segments dictate the growth rates of the retail loan segment.

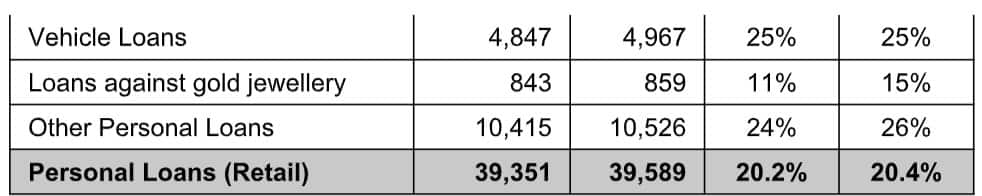

As of Jan’23, the YoY overall credit growth was 16.7 percent. During the same period, the retail loan growth was much higher at 20.4 percent.

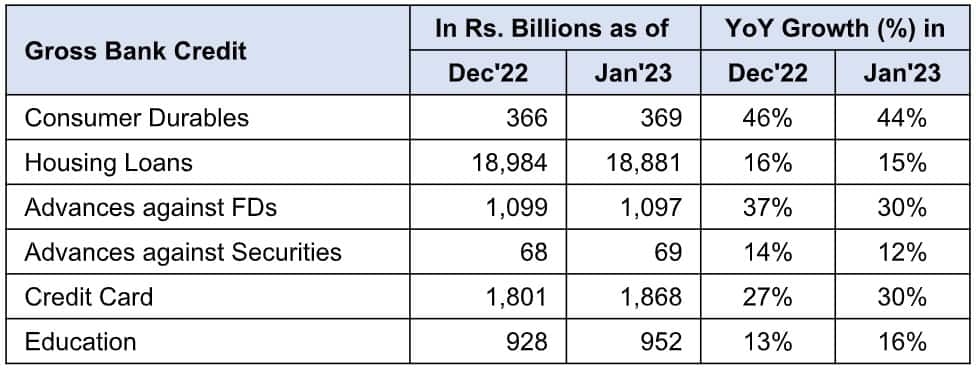

In retail loans, segments such as consumer durables, housing loans, advances against FD and securities have all seen some moderation in their growth.

While segments such as credit cards, education, vehicle loans, loans against jewellery, etc., have seen higher growth than in Dec’22.

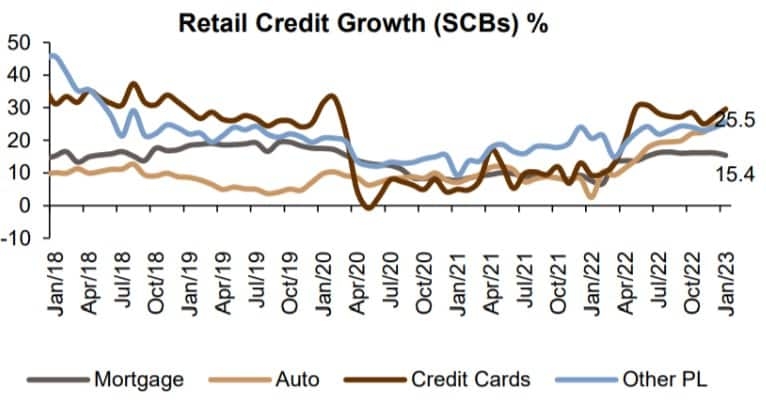

Trends across the major retail loan segments

Housing loans

Housing saw robust demand till the month of December, but there has been some moderation since the month of January.

The moderation in demand is owing to the decline in the investment-related demand within the prime housing category and the reduction in the balance transfers.

Rate hikes and inflationary pressure has led investment-related demand to defer.

The balance transfer volume has come off as banks are retaining customers by offering lower rates.

The end-user demand is still intact and not affected by the higher rates. Even the affordable segment has not seen demand reduction given lesser rate sensitivity.

Overall, the housing loan segment is poised to do well as the interest rates stabilise.

Loan against property

Loan against property (LAP) has been fairly resilient. The increasing funding requirement for the business on the back of improved activity has increased the volume of loans against property.

A shift in focus by the lenders can be seen from housing loans to LAP and business loans.

Auto loans

The auto loan growth had begun to pick up only in Q2FY23. Auto loan demand has not been impacted much by the rate hikes as they have lesser rate sensitivity.

With auto demand above pre-covid level, domestic auto demand is expected to remain buoyant and consequently the auto loan demand as well.

Personal loans and credit cards

Personal loans have seen a moderation in volume owing to the hike in rates from 10-11 percent in the months of Sept’22 to 12-13 percent currently.

The rate hikes have not been as steep in the salaried personal loans particularly in the government and category A customers as the delinquencies are far lesser in this segment.

For credit cards, the overall net additions have improved to 1.3 million and spending was up 45 percent YoY in Jan’23.

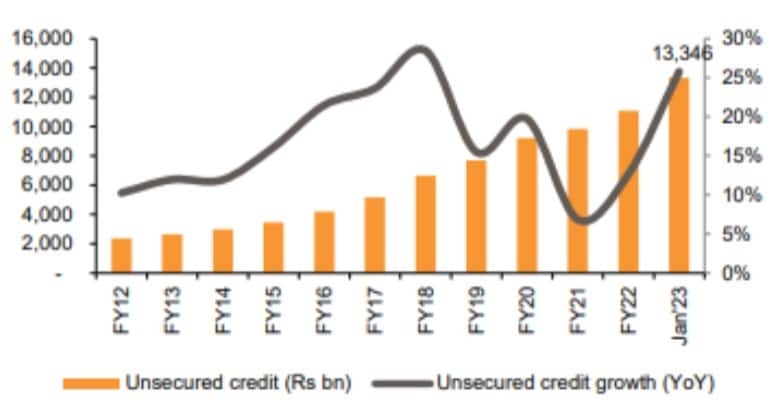

Going forward banks are looking at a faster growth in the unsecured credit business i.e credit cards and personal loans segments.

The credit growth has been robust across all the segments including the retail loans segments.

With nearly one-third of the bank credit being contributed by retail loans, growth in this segment has a major impact on the growth of Banks and NBFCs.

While some pockets have seen a moderation in demand due to rate hikes, the structural demand continues to remain buoyant in major segments such as housing loans, auto loans, personal loans, and credit cards.

(The author of this article is CIO, Research & Ranking)